Make the most of pension tax relief by 5 April

Most personal payments you make into your pension get topped up by the government with tax relief. Each tax year, you can make payments up to 100% of your income or the standard allowance of £60,000, whichever is lower.

It’s a tax-efficient way of preparing for the future.

Remember, you can’t normally access your pension before the minimum pension age (currently 55, increasing to age 57 from 2028).

Top up today

You can make one-off debit card payments at any time. It’s safe, secure and takes just a couple of minutes.

Sign in to Online Service or use the app to make a payment.

Get into a good habit

Regular pension contributions can compound, particularly when you’re investing over decades. A monthly Direct Debit is a hassle-free way to make pension contributions a consistent habit.

You can adjust or pause your payments whenever you need.

Be tax savvy

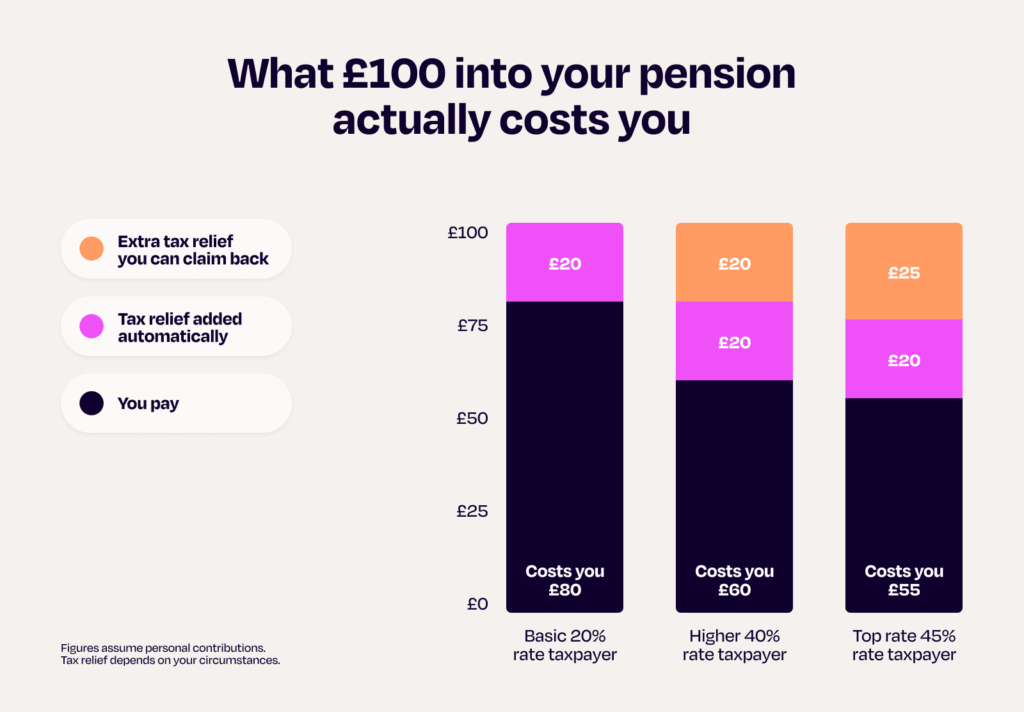

When you make a payment, we collect basic rate (20%) tax relief from HMRC on your behalf, and put it straight into your pension.

If you’re a higher (40%) or additional (45%) rate taxpayer, you can claim extra tax relief through your Self Assessment tax return. You’ll receive the extra relief as a rebate, a reduction in your tax bill, or as a change to your tax code.

Don’t hang about

- This tax year ends on 5 April

If you want to make the most of this tax year’s tax relief, you’ll need to contribute to your pension before 5 April.

If you don’t use your full pension allowance in a tax year, you may be able to carry it forward for up to 3 tax years. This will depend on your circumstances and rules may change. If you need advice, speak to a qualified and registered financial advisor.

- Pensions are a long-term investment

Markets rise and fall, but investing over time gives your pension the best chance to grow for the retirement you want.

Even small steps now could make a difference to your future.

Remember, the value of investments can go up and down, so you may get back less money than you put in. Tax depends on your individual circumstances and the regulations may change in the future.

Questions and answers

How much can I pay into my pension this year?

Most people can receive tax relief on contributions up to 100% of their earnings. There’s an annual allowance of your annual income or £60,000, whichever is lower.

If you contribute above your annual allowance, you may be liable to pension savings tax charges. More info (including different limits for high-earners) is available at gov.uk.

What if I didn't use my full allowance in previous years?

You may be able to carry forward unused allowance from the past three tax years, depending on earnings and eligibility. More info is available at gov.uk.

Speak to a qualified financial adviser if you need advice. Octopus Money can offer financial and wealth planning advice, go to octopusmoneydirect.com/planning (additional charges may apply).

Do I get tax relief if I don’t earn enough to pay income tax?

Yes, you’ll still receive tax relief on the first £2,880 you contribute each year.

Can I combine other pensions?

Yes, you can consolidate them to keep track and stay organised. Learn more here.

Before transferring, check whether your current provider charges fees and whether you might lose any valuable benefits.

Speak to a qualified financial adviser if you need advice. Octopus Money can offer financial and wealth planning advice, go to octopusmoneydirect.com/planning (additional charges may apply).

Can I make a payment over the phone?

If you want to make a one-off payment or make changes to your account over the phone, give our team a call on 03455 28 88 88.

We’re here to help Monday-Friday 8am-9pm, and Saturday 9am-6pm.