Make the most of your ISA allowance before 5 April

Every tax year you can invest up to £20,000. Use it or lose it – unused allowance can’t be rolled over.

Top up your ISA

You can make one-off debit card payments online any time, within your allowance.

Invest monthly

Small, regular monthly payments can make a big difference, helping to smooth out market ups and downs. You can adjust or pause whenever you need, just sign in online any time.

Consolidate your ISAs

Move your stocks and shares or cash ISAs into one easy-to-manage pot.

It won’t impact your annual limit, but check for exit fees before you switch.

Remember, the value of investments can go up and down, so you may get back less money than you put in. Tax depends on your individual circumstances and the regulations may change in the future.

Don’t hang about

- The Deadline is 5 April

Your ISA allowance resets on 6 April 2026, and you can’t roll unused allowance forward.

- Tax-Free Gains

Returns in an ISA are tax-free, unlike interest on savings or returns in a general investment account.

- Shifting Tax Policy

Changes to dividend and savings income tax (outside of wrappers like ISAs) make Stocks & Shares ISAs more important than ever. Read more about the 2025 November Budget.

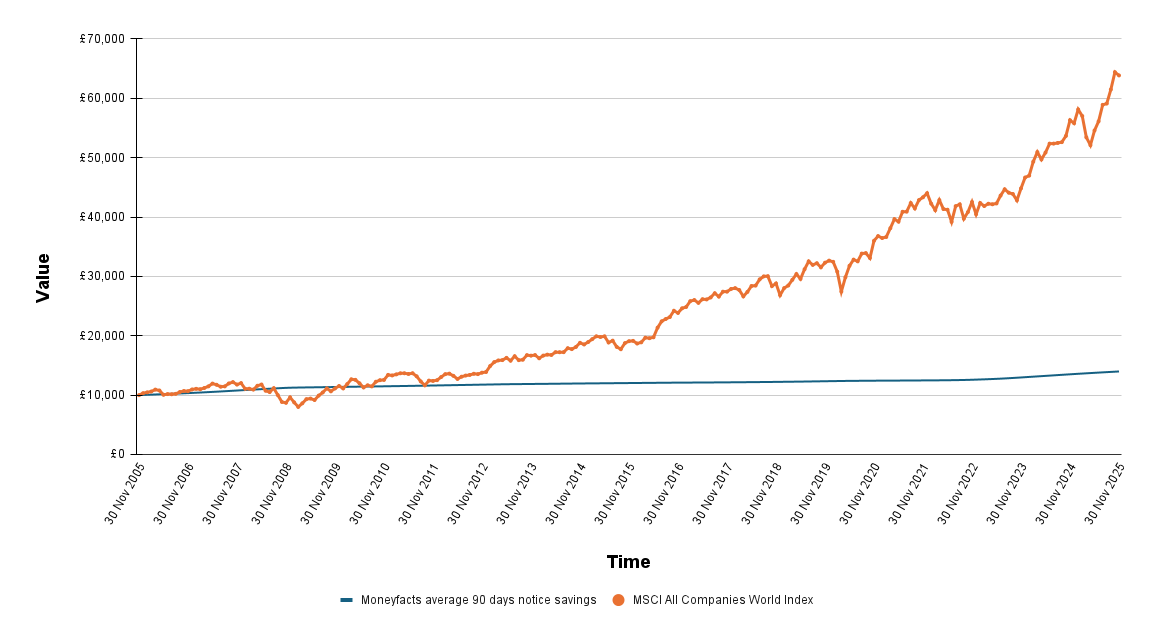

- Cash vs. Investments Long Term Growth

Cash is valuable for short-term goals, where you need easy access and if 100% capital protection is vital. For long-term goals, cash savings may not keep up with inflation.

Historically, stock markets have generally grown more than cash savings over the long term. While markets have ups and downs, time in the market matters.

Investment vs savings returns over the last 20 years

This chart shows the growth of a £10,000 lump sum saved or invested since November 2005

Source: Lipper, using Moneyfacts and MSCI. Remember past performance is not a reliable guide to future performance.

The deadline is approaching – don’t lose this year’s tax-free allowance.

Any questions?

See our help section

Useful links

Questions and answers

How much can I invest in an ISA this tax year?

In the 2025/26 tax year, the annual ISA allowance is £20,000 across all your ISAs — not per account.

If I don’t use my ISA allowance, can I roll it over into next year?

No — if you don’t use your ISA allowance in a tax year, you lose it. It doesn’t carry forward.

Can I have more than one ISA at the same time?

Yes — you can open more than one ISA in the same tax year, including two or more of the same type (e.g., multiple Stocks & Shares ISAs).

However, you can’t contribute more than £20,000 in total across them in one tax year.

Can ISA growth push me over my allowance?

No — your allowance only applies to what you put in, not what it grows into. Any returns inside your ISA are not subject to income or capital gains tax.

What happens if I accidentally contribute more than £20,000?

If you go over the allowance, you can contact HMRC — or they will contact you and let you know how they plan to adjust for the overpayment.

Can I inherit a partner’s ISA allowance?

Yes — spouses and civil partners can inherit an Additional Permitted Subscription (APS) allowance equal to the value of the ISA held by the partner who passed away.

How are ISA rules changing in future years?

From April 2027, the tax-free allowance on cash ISAs will drop from £20,000 to £12,000 for under-65s — there’s no change for over-65s. Read more about the 2025 November Budget.

Does transferring an ISA affect my allowance?

No — ISA transfers don’t reduce your annual allowance, even if you transfer the full balance.

Can I make a payment over the phone?

If you want to make a one-off payment or make changes to your account over the phone, give our team a call on 03455 28 88 88. We’re here to help Monday-Friday 8am-9pm, and Saturday 9am-6pm.