There’s growing debate in the UK about how to encourage more people to invest for the long term. The government’s thinking is that this will not only help boost British businesses, it will also be better for savers, as investments generally result in better returns over the long term than cash.

There’s no absolute certainty with investing (and past performance is not a guide to future performance), but according to the Treasury, based on current trends in 2025, savers who move £2,000 from a low-interest account (with a return of around 1% – better rates are available) into stocks and shares, could see an increase of more than £9,000 over the next 20 years.

The so-called ‘Leeds Reforms’ announced by Chancellor Rachel Reeves in her Mansion House speech in July included:

- The Financial Conduct Authority (FCA) will bring in a new targeted support regime to improve the availability and affordability of help with financial decision-making, including deciding between saving in cash and investing.

- A review of risk warnings on investments products to help people more accurately judge risk levels.

- Consideration of future “reforms to ISAs and savings to achieve the right balance between cash savings and investment”.

The Chancellor’s Budget statement in Nov 2025 followed up on this with a reduction in the annual tax-free allowance for cash ISAs from £20,000 to £12,000. ISA savers under 65 can still invest up to £20,000, but £8,000 of that will need to be in a stocks and shares ISA. But while investing can offer better returns than cash savings over the long term, it can also be a bit daunting for first-timers. So how do you decide what’s right for you?

Saving or investing – what’s the difference?

Cash savings are usually held in a savings account with a bank or building society. They’re low risk and easy to access.

Investing means putting your money into things like shares, bonds or funds. These can go up or down in value. Over time, investments have the potential to grow more than cash savings – but they can be subject to market ups and downs in the short term.

Why inflation matters

Inflation is the rate at which prices rise. If your savings earn less interest than the rate of inflation, the value of your money goes down in real terms. For example, if inflation is 4% and your savings earn 2%, you’re losing spending power.

Investments can help protect against inflation because they have the potential to grow faster than prices rise (though they can also carry more risk).

Learn more about inflation’s effect on investments.

Understanding investment risk

Not all investments are the same. Some are riskier than others. Shares in smaller companies or in certain countries may rise or fall more sharply. Bonds and funds that invest in a mix of assets may be more stable.

At Octopus Money Direct, we explain these differences in our Learning Hub. It’s a great place to learn about the types of investments available and how to match them to your needs. Whether you’re new to investing or want to build your knowledge, we’ve got you covered.

Learn more about investment risk.

What history tells us

Looking at long-term trends can help you understand the pros and cons of saving versus investing. Over the past 20 years, stock markets have generally grown more than interest rates on savings accounts. So people who invested during that time often saw better returns than those who kept their money in cash.

However, there have also been periods when markets fell sharply – like during the 2008 financial crisis or the early days of the Covid-19 pandemic. That’s why it’s important to think long term and avoid making decisions based on short-term market changes.

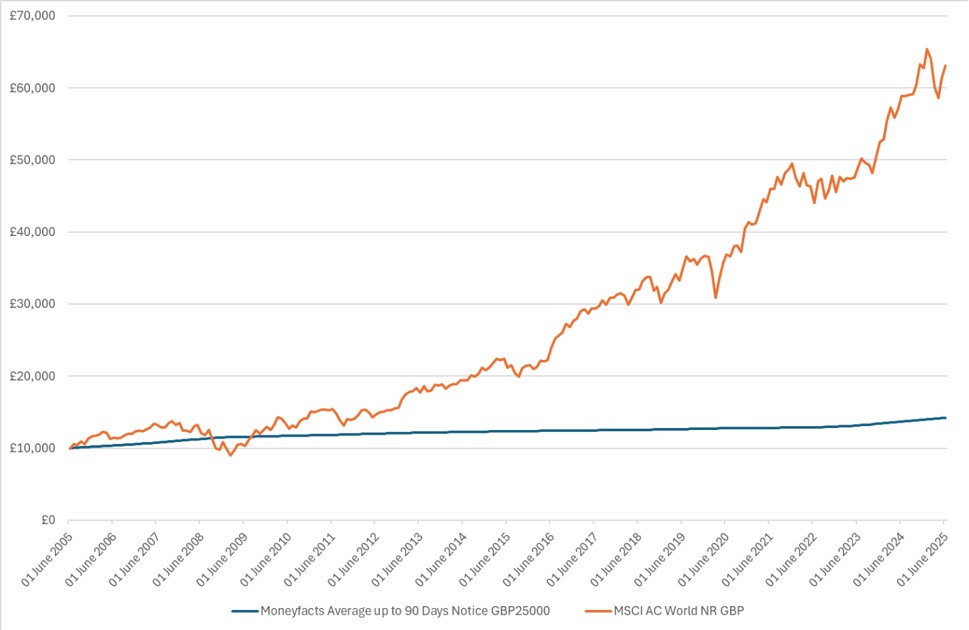

Returns from £10,000 in cash and investments (example)

This chart shows the growth of £10,000 saved or invested as a lump sum in June 2005. The cash returns are represented by the Moneyfacts average up to 90 days’ notice account rate for a typical £25,000 deposit. Investment returns are represented by the MSCI All Companies global stock market index performance, with all income reinvested and currency set to GBP.

Source: Lipper, using Moneyfacts for cash and MSCI for global stock market performance.

Note: Past performance is not a reliable guide to future performance.

Taking your first steps into investing

Investing can seem a bit scary at first, and many people worry about making mistakes. But you don’t need to be an expert to get started. Our Stocks and Shares ISA is a good place to start – it’s designed especially to help new investors:

- You can pick from three ready-made options based on how much risk you’re okay with – cautious, balanced or adventurous. All our funds are invested worldwide to spread the risk and give more opportunities for growth

- We handle the research and pick a mix of companies and other assets

- We use simple language to help you understand investments and risk

Learn more about our investment products.

See our latest market updates and insights.

We hope the information in this article is useful, but it isn’t financial, personal or tax advice. If you’d like advice, Octopus Money can provide professional help. Remember, the value of investments can go up and down, so you may get back less money than you put in.

You should think of investing as a medium to long-term commitment – so be prepared to invest your money for at least five years. Tax depends on your individual circumstances and the regulations may change in the future.